More hype than reality – FOBAMI

This is the first article in Common myths and misconceptions about Bitcoin debunked series.

Quantum computing often raises concerns about the future of Bitcoin, with some fearing that these powerful machines could one day threaten its security. While the concern is understandable, a closer look reveals that quantum computing is far from an immediate threat to Bitcoin. Here’s why investors, bitcoin holders, and the like can stay confident.

Cryptographic foundations of Bitcoin

Bitcoin’s security is based on two main cryptographic tools:

- ECDSA (Elliptic Curve Digital Signature Algorithm): Protects private keys and authorizes transactions.

- SHA-256: Ensures data integrity, obfuscates addresses and powers Bitcoin’s Proof-of-Work mining.

The theoretical threat of quantum computing to Bitcoin lies in the possibility of breaking these cryptographic tools. Specifically, the two most commonly cited algorithms are:

- Shor’s algorithm, which an attacker could use to derive private keys from public keys.

- Grover’s Algorithm, which an attacker could use to reduce the computational effort required to reverse the SHA-256 hashing mechanism.

While these threats are theoretically possible, quantum computing is far from the power needed to execute them.

How far are we from quantum computers that could threaten Bitcoin?

Current quantum computers are decades away before it could break Bitcoin encryption.

To break down ECDSA in one hour you would need approx 317 million physical qubits. Today’s quantum computers have approx 100 qubits. Even if the timeline were extended to five yearswould still take around 6000 qubits break ECDSA.

Similarly, while Grover’s Algorithm could theoretically reduce the effort required to crack SHA-256 from 2^256 operations to 2^128, this still represents an astronomically large number of calculations.

For context, Google’s latest quantum processor, Willowhe just has 105 qubits. According to the physicist Sabine Hossenfelderpractical applications of quantum computing are “about 1 million qubits” away and remain so decades from reality. When it comes to breaking a cryptographic code, the request jumps to 13 million qubits or more.

Based on Moore’s Lawit probably will at least a decade or longer before quantum computers threaten Bitcoin in its current state.

See the graphic below for an illustration of possible timelines for quantum progress according to Moore’s Law.

A quantum leap towards reality

Even Google’s much-vaunted claims of “quantum supremacy” have been met with skepticism. IBM pointed out that the same calculations can be achieved using classical supercomputers in reasonable time frames.

Kevin Roseformer senior product manager at Google, noted that while Willow’s 105 qubits represent progress, they are far from 13 million qubits needed to break Bitcoin encryption.

Why Bitcoin is resistant to quantum progress

Bitcoin’s design gives it built-in advantages against attacks:

- Difficulty adjustment: Bitcoin’s Proof-of-Work system adjusts the mining difficulty every 2016 blocks to maintain a consistent block time of ~10 minutes. If a quantum computer were to mine blocks faster, the network would adapt and prevent unfair advantages.

- Public key security: Public keys are only revealed when you spend coins. The best practice is never reuse addresses that the assets will be safe even against quantum threats.

- Condensed addresses: Addresses based on hashed public keys (p2pkh) add another layer of protection, making it more difficult for attackers to exploit quantum weaknesses.

These features mean that even if quantum computers could break Bitcoin’s entire encryption tomorrow, not every wallet would be vulnerable. In addition, the network can respond to emerging threats in real time.

Preparing for the future: Bitcoin’s ability to adapt

If quantum computing eventually threatens current cryptography, Bitcoin has options:

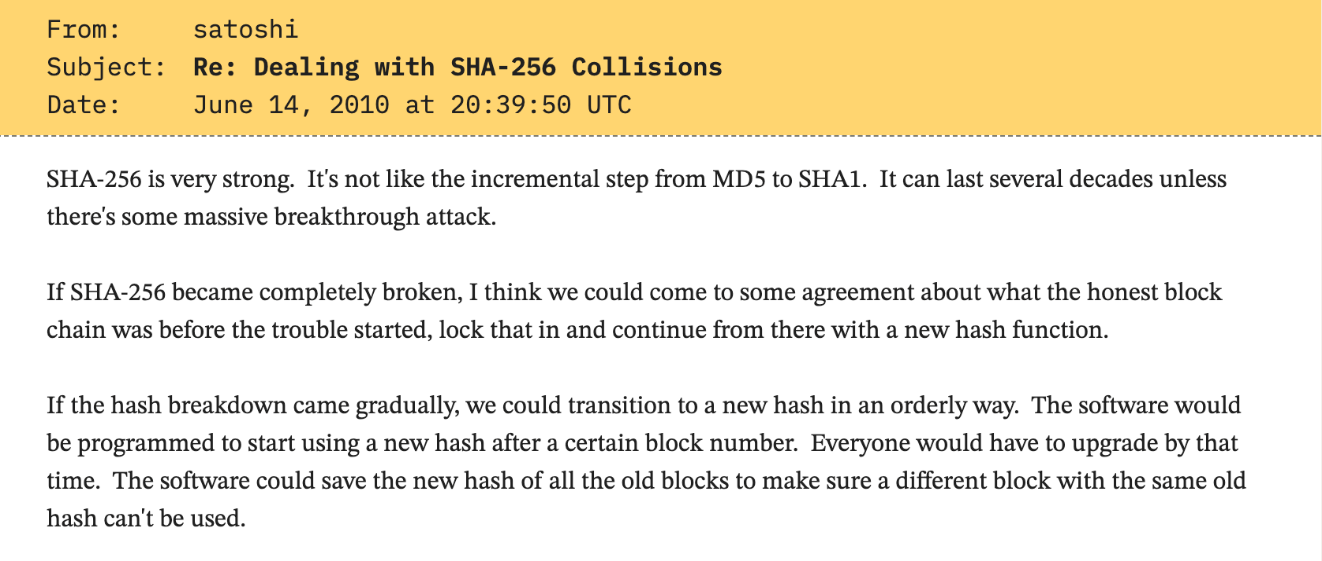

- Upgrades: As suggested by Satoshi Nakamoto in 2010, the network could switch to more quantum-resistant algorithms if the need arose. For example, Bitcoin could upgrade from SHA-256 to SHA-512. Depending on how imminent the threat appears, the network can adapt in one of two ways:

- Community-driven solutions: Bitcoin’s decentralized governance enables quick, shared decisions. Developers are already working on solutions. For example, the so-called soft fork proposal QuBit by Bitcoin developer Hunter Beast (@cryptoquick) introduces post-quantum public keys.

As Satoshi said, SHA-256 is much stronger than most other cryptographic algorithms, which means that quantum computers pose an even greater risk to other critical web infrastructures.

Quantum threats are not just a bitcoin problem

Quantum computing doesn’t just challenge Bitcoin – it threatens it all cryptographic systemsincluding:

- Internet encryption as a whole

This shared risk drives global research into post-quantum cryptography. The world is aware of the potential threat and is actively developing solutions.

Due to its decentralized nature and built-in incentive structure, Bitcoin is uniquely positioned to implement a solution. If a new threat emerged that could weaken the security of the trillions of dollars stored in the network, users would react quickly and invest energy and resources in strengthening the network. In contrast, for example, rebuilding and restarting the infrastructure of a global bank can take much longer than performing a soft fork in the Bitcoin code.

Bottom line: Bitcoin is made for development

Quantum computing is still in its infancy, with the technology likely needed to challenge Bitcoin’s security decades away. Bitcoin’s flexibility, strong cryptographic foundation, and decentralized management position it to easily face any challenge.

Quantum FUD (Fear, Uncertainty and Doubt) should not overshadow Bitcoin’s resilience and potential. As quantum computing advances, so will Bitcoin’s ability to evolve and remain secure.

Post Comment